DIGIWORLD IN SEARCH OF THE PUZZLE PIECE

Shifting its model from traditional distribution to providing market expansion services, Digiworld continuously conquered new milestones and changed its business position.

On December 23, Digiworld Corporation officially signed a strategic cooperation agreement with Whirlpool - America's leading household electrical appliance company, marking a milestone in entering the household goods industry with an annual market size of 2.4 billion US dollars. Digiworld is not just a distributor but has signed a strategic exclusive contract to provide lump-sum MES (Market Expansion Services) for Whirlpool in Vietnam, with the ambition to achieve 10% of total market size within 3-5 years.

Whirlpool is still a newcomer in Vietnam market but is America's No. 1 home appliance brand. In the list of 2000 world largest public companies 2021 (Forbes Global 2000), Whirlpool ranked 665 with revenue of USD 19.4 billion, profit of USD 1.1 billion and asset value of USD 20.4 billion. “This cooperation plays an important role in the business strategy and expansion of new fields and industries that will contribute to Digiworld revenue from 2022,” Mr. Doan Hong Viet, CEO of Digiworld told Forbes Vietnam.

Constantly looking for partners to open new brands and merchandise categories is the recent five-year step of a 25-year-old distribution company. Mr. Viet, born in 1970, majored in economics in Hanoi, graduated in 1992 and worked for a computer distribution joint venture in Vietnam before founding Digiworld. “I took a few more computer practice sessions and programming, and later loved it, I learned it by myself,” Mr. Viet said.

After more than 20 years of rooting in three main merchandise categories: computer, mobile phone and office equipment, Digiworld has begun to conquer home appliance merchandise category. However, long before that, to create space for growth, they opened two new merchandise categories: fast moving consumer goods (FMCG) and healthcare. In 2017, Digiworld bought CL distribution company and entered FMCG industry. At that time, CL had established a national distribution system with high-end products of Lion Corporation (such as Kodomo, Zact Lion and Systema); Essense and Bio Zip laundry detergent, Bubbi King dishwashing liquid… In 2019, they entered the healthcare industry when they gained distribution rights with Nestlé for special nutritional products through the hospital channel, followed by contracts of distributing musculoskeletal products.

Mr. Viet founded Digiworld (originally named Hoang Phuong) in 1997 – a memorable time when the Internet began to spread in Vietnam. However, computers were still a luxury product, they sell components from Taiwanese firms for the need to assemble desktop computers which inherently costed only about 40-50% of genuine full-set computers. “Fortunately, the more popular the Internet is, the more the demand increases, making the business profitable and growing from the beginning,” he said.

In the early 2000s, laptop owners were mainly given by relatives abroad or had someone buy on behalf. Going to Thailand, Mr. Viet found laptops very popular, judged that this trend would come to Vietnam, he connected Acer - the first brand they gained the distribution rights. Acer started its genuine business in Vietnam and Digiworld stirred up the market with the program “USD 999 laptop”.

“Distribution is the last stage of the market, depending on many things,” Mr. Viet shared about many risks he experienced. In 2001, the company distributed the board to a major firm, accounting for 40-50% of the market share, but the defective shipment caused them to get heavy losses and had to compensate the agents. “The lesson: making components is too risky, it is necessary to 'play' with big guys for smooth business, easy after-sales," Mr. Viet told that Digiworld had to change its way of doing business, step by step gaining distribution rights with most of the well-known brands such as HP, Dell, Asus, Lenovo, Toshiba... Today Digiworld provides market development and distribution services for about 30 world technology brands through a system of more than 16,000 agents.

Another risk was that in 2008, Digiworld distributed Dell laptops for the first time, Mr. Viet said "in the opening day, the sesame tree flower bloomed very beautifully in front of the door, he secretly thought of fortune". However, the exchange rate jumped every hour. Import goods were in US dollars, but the domestic currency was calculated in Vietnam Dong. "The exchange rate went up rapidly, the loss was right in front of my eyes but I didn't see any fortune".

The annual scale of telephone industry is USD 3.5 billion, compared with USD 2.4 billion in electronic home appliance industry and nearly USD 1 billion in computer industry. From 2003, distribution of mobile phones mainly belonged to big guys with multiple strengths such as FPT, Petrosetco or Lucky. In 2013, Digiworld seized the opportunity when undertaking Nokia distribution, at some time this item accounted for 50% of Digiworld's sales, but two years later Microsoft bought Nokia and changed its strategy. “Everything is going very well, but suddenly we lose completely,” he said.

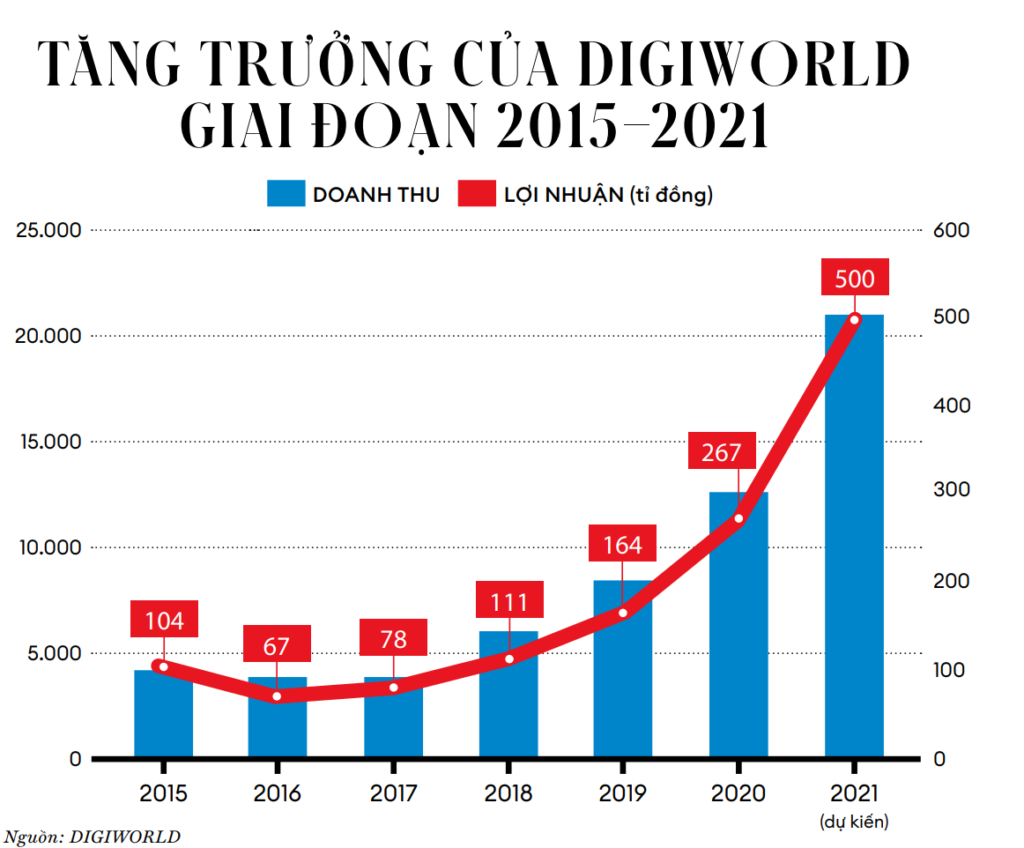

In 2016, Digiworld's revenue decreased by thousands of billions and the profit recorded a decline of 40% compared to the previous year. Although distributing other phone brands such as Wiko, Obi Worldphone... and specialized services for new brands entering Vietnam, it has not yet made a mark. It took them nearly two years to get the same results as when they were listed on HoSE (in 2015).

Digiworld really changed its position in the phone industry after handshake with Xiaomi in 2017, gaining exclusive distribution when this brand was not prominent globally and in Vietnam. The promotion of Xiaomi's market share led to a prosperous business result. If, in 2019 Xiaomi's market share was out of Top 5, in the second quarter of 2020 it was in Top 3 with 10%, according to Counterpoint data, in the second quarter of 2021, it was up to the second position with 17%. In 2020, Digiworld continued to win the right to distribute Apple and the exclusive MES supply contract with Huawei, its business continuously became prosperous, pushing the average annual growth to 40-50% in 2018-2021 period.

During two years of COVID-19 pandemic, they benefited from a spike in the computer market for online work and study needs, plus increased sales from Xiaomi, Apple and Huawei device groups, Digiworld conquered impressive milestones: revenue in 2020 increased by 48% to VND 12,535 billion and its net profit increased by 56% to VND 253 billion. Revenue and profit in the first nine months of 2021 exceeded the full-year level of 2020, up 53% and 96% respectively over the same period. Mr. Viet estimated that by the end of 2021, it could reach VND 21 trillion compared to the plan of VND 15,200 billion and profit about VND 500 billion compared to the plan of VND 300 billion, up 67.5% and 97.6%, respectively, compared to 2020.

The oriented strategy of becoming a market development service provider has helped Digiworld make a difference. In 2015, Digiworld's revenue was approximately VND 4,250 billion, far lower than its direct competitor, PSD with VND 5,700 billion; In 2018 it surpassed PSD to become top 2 largest distribution company with Synnex FPT and in the first nine months of 2021, DGW's revenue was more than twice and its profit was more than three times than that of PSD. Mr. Viet said that positive results were thanks to going with new firms to Vietnam and providing MES services from market research to sales and after-sales. "If we only import and distribute, we can only rely on available market demand or made by firms, but we need to create demand to promote scale and increase market position," according to Mr. Viet.

MES supply model is operated by Digiworld in a complete chain: market analysis and business planning; marketing; sales; logistics (import, warehousing, distribution); and post-sales. They are also a pioneer in D2C (Direct to Customer) e-commerce distribution solutions in Vietnam, providing exclusive rights for brands, from initialization – e-store management, production – content, advertising campaign, marketing management... to order, warehouse and freight management. Digiworld also emerged with an exclusive store operating model for brands (brandshop), from location selection, design, recruitment and training to store operation for partners such as Xiaomi, Huawei...

The proportion of revenue in two segments of FMCG and health care is still very small, Mr. Viet estimates that in 2021, it will reach about VND 500 billion in total revenue of about VND 21 trillion. Total revenue according to the plan in 2022, will reach about VND 28 trillion, these two segments are expected to contribute VND 1,000 billion. “The growth plan is more than 100% next year but it is still very small, less than 5% of total revenue and compared to total market size, it is 'like salt in the sea'," Mr. Viet explained. In September, Digiworld announced an investment of VND 9 billion to own 36% of Dai Tin Pharmaceutical Company, specialized in providing pharmaceuticals, medical equipment and pharmaceutical preservation services. This move has helped it expand its product channel to include over-the-counter drugs.

Why is the growth in two segments almost unrelated? Mr. Viet is confident of MES supplier, whose system development stages are quite similar, so it takes advantage of management data, financial infrastructure, logistics, management software… “Business process for channels can be similar, the investment is mainly in people, it needs experienced people who are knowledgeable about the field and industry”. According to Mr. Viet, the opportunity to expand to new merchandise categories is very large, especially FMCG and healthcare markets have still been very fragmented. The FMCG industry alone has an annual turnover of over USD 15 billion.

“Pursuing DKSH model in the healthcare industry is the way that Digiworld has been doing,” Mr. Viet shared with Forbes Vietnam. The global pharmaceutical distribution industry is dominated by DKSH Holdings and Zuellig Pharma with the race to "internationalize" local markets. DKSH with its MES model has hundreds of years of experience, its professional and financial capabilities are far from domestic companies. Among top 5 distributors in Vietnam, DKSH and Zuellig Pharma have annual revenue of billions of dollars, far from the rest of the companies by VND 4-5 trillion.

According to BMI Research, the size of Vietnam's pharmaceutical market will reach VND 7.7 billion in 2021 and exceed USD 16 billion by 2026, growing at a compound annual rate of 11%. “Digiworld is ambitious to be in the top 5 healthcare distributors by 2025,” he said. Method: Based on in-depth understanding of the domestic market and focusing on small-volume brands (DKSH and Zuellig Pharma distribute brands with millions of dollars). He explained that the distribution channel pressure was great, when the scale was not large enough and the operation was expensive, it focused on providing online - offline services - operating D2C platform for brand segment of 200-300 billion scale. “We do a very small part of the value chain at a cost that is affordable to the masses, which is an opportunity to increase my position,” he said.

Mr. Viet runs Digiworld with two members who joined the company in the early years: Ms. To Hong Trang, his life partner, currently plays the role of developing the company's organization and corporate culture; and Ms. Dang Kien Phuong, playing the role of Chairman of the Board of Management from 2020 after the regulation on separating the titles of chairman and CEO in the enterprise. The founder and his wife hold 34% of the company's shares, BOM members about 13% and foreign organizations about 28%. “How does the family business model affect business decisions?” – Mr. Viet replied: “It is not possible to evaluate a family company by the number of owned shares, Digiworld needs many employees to meet the growth rate of different channels, it is important that the organization has a clear demarcation, put the right personnel in the right roles.”

According to Ms. Tran Khanh Hien, Research Director of VNDirect Securities, the growth driver for Digiworld in 2022 is that consumer demand will increase again on the low base of 2021; The market is driven in the direction of omni-channel shopping, helping Digiworld benefit when they boost their business through operating genuine stores on Lazada, Shopee or Tiki. Products in the Xiaomi ecosystem that are gradually becoming popular in Vietnam are also the driving force for Digiworld in the coming years.

While according to Mr. Le Quang Minh - analyst director of Mirae Asset Vietnam, Digiworld went against the difficult trend of the market and grew steadily thanks to the sudden increase in demand for ICT equipment in households for learning and entertainment, work... changing people's habits in the medium term. The disruption to the supply chain caused supply not to meet demand, helping increase the gross profit margin of both wholesalers and retailers.

The ICT market still has a lot of potentials to be exploited, which will help them maintain positive growth. However, Digiworld will face competition from major retailers that have an adequate logistics system and reach enough consumption scale that can buy goods directly from the manufacturer. “If they increase market share, Digiworld's potential market share will shrink, the same is true for the FMCG industry,” Mr. Minh said.

The FMCG industry is vulnerable to risks due to high logistics costs, overdue cancellations and short product life cycle. For wholesalers, besides low profit margins, risks from receivables and inventories usually account for a large proportion of total assets (with Digiworld about 80% at the end of Quarter 3 of 2021). If consumption does not meet expectations of the cycle, costs will increase, and if demand stimulus is enhance, profit margins will be narrowed. “Business performance depends on the accuracy of the plan.” However, a representative from Mirae Asset said that by focusing on green development, Digiworld attracted investment from Probus Opportunities - a Swiss investment fund for green businesses . "This can help the company better mobilize cheap capital in the future," Mr. Minh said.

Since its establishment, Digiworld has grown at an average of 37% per year. Mr. Viet said that the larger the scale was, the narrower the growth rate was, but the message throughout and in the long term was to keep a compound growth rate of 25% per year, equivalent to doubling revenue and profit every three years on average. “We don't look at numbers that are sudden and short-term because each merchandise category goes up and down, fast and slow through different periods, that's business happening every day. The market opportunity is very large, if following the right strategy, the speed will be kept,” Mr. Viet said.

Digiworld digitally transforms overall management with SAP S/4HANA Cloud & IFRS

28/07/2023

DIGIWORLD WELCOMES 25th BIRTHDAY WITH PRESTIGE AWARDS

14/12/2022

TCL LAUNCHES A NEW SMARTPHONE SERIES, GENUINELY DISTRIBUTED BY DIGIWORLD

19/09/2022

IR AWARDS 2022: DIGIWORLD JOINS THE MID CAP RACE WITH DOUBLE PRIZES

15/09/2022